Deferred payment for business (BNPL)

More and more entrepreneurs and consumers appreciate the ability to make a purchase at any time, regardless of whether they have free funds. Offer your business clients deferred payment!

Deferred payment for business

How does BNPL work for B2B?

Buy Now, Pay Later is a payment model in which a buyer can order a product and pay for it later. The seller, though, receives the money right away and may start processing the order immediately. It’s an alternative to trade credit, making your company risk-free!

The buyer may chooose to pay for the order in 14, 21, 30, 45 or 60 days,

Automatic rollover for failure to repay on time,

They get up to 25.000 EUR revolving financing limit,

Quick decision and fully-online process,

PLN or EUR – transaction currency of your choice,

Many possibilities for technical integration.

Deferred payment benefits

How to launch BNPL in your company?

Business meeting

Technical training

Implementation

Successful cooperation with partners

We establish partnerships with companies in all industries, and our cooperation brings tangible benefits. The numbers speak for themselves!

0

active partners

0%

accepted applications

0 K

successful

transactions

0 MM PLN

financing provided

What do the partners say?

Check out what our long-time partners think about working with PragmaGO.tech!

Ewa Krainska

B2B Financial Services Senior Manager, Allegro

We are working with PragmaGO to offer modern financing methods for companies that sell on Allegro. Our choice of partnership wasn’t accidental. From the very beginning, PragmaGO demonstrated not only professionalism and promptness but, most importantly for me, flexibility and willingness to experiment. Together, we create a new quality in the market of corporate financial tools for ecommerce sector. Above all, we are guided by the idea of searching for the essential characteristics of the sector. Starting from product design and UX, to technology solution, we build outstanding solutions for the industry. This is what sets our financial methods and products apart from those available in the industry. PragmaGO is not afraid to take risks and try new solutions. They actively participate in strategy building and are heavily involved in every project.

Lukasz Piechowiak

Head of Financial Services, Shoper

Cooperation with PragmaGO is very smooth and based on partnership. Our shared commitment to product development and improvement stands out. These are based on the best technologies and years of experience in online business financing. Online stores using the Shoper platform need financing that is technologically advanced, flexible, fast and transparent – which is exactly what PragmaGO delivers. As a result, the customer can apply for a convenient and attractively priced loan literally in a few minutes. Without leaving home, completely online, day or night. The money can then be used to further develop their e-shop exactly when they need it and when it is convenient for them. Thanks to the cooperation with PragmaGO, our users can experience the practical benefits of implementing modern fintech solutions in business.

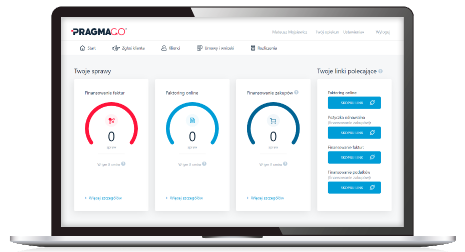

Enter the Partner Zone and get free assets!

After we establish cooperation, you will get access to the Partner Zone. It’s a functional panel where you’ll find ready-to-use marketing assets, among other things. Just download and start using them to your advantage! The package contains:

- advertising banners,

- social media posts ideas,

- mailings,

- instructions for customers on how to use provided services,

- materials for IT departments, including API documentation and swagger

…and much more!