Company Loan

(from Brutto.pl of the PragmaGO Group)

Case Study

Shoper is a turnkey software for running an online store (SaaS). The platform allows for comprehensive support of e-business – from graphic creation of the store, through orders to advanced statistics. Shoper merchants also have access to additional services, including financial services.

Corporate loan (from Brutto.co.uk

from PragmaGO Group)

Where did the idea for the service come from?

Shoper offers a number of additional solutions for its customers to make running e-commerce easier – in one place. Among them, financial services (so-called embedded finance) cannot be left out. This is a very important segment – access to cash at the place of business is an opportunity to buy goods, pay for expenses, invest in marketing, and thus develop e-business. Shoper was looking for an experienced financial institution with the technological background to effectively integrate the service. Brutto.pl of the PragmaGO Group is a fintech with years of experience in financing the SME sector. The company has both the technology to develop innovative embedded finance services (created by PragmaGO.tech) and a stable financing provider (PragmaGO).

Cooperation with PragmaGO is very efficient and a full partnership. It is distinguished by a common desire to develop and improve the product based on the best technologies and many years of experience in financing online businesses. E-stores using the Shoper platform need financing that is technologically advanced, flexible, fast and transparent – this is the product provided by PragmaGO. As a result, in just a few minutes, without leaving home, completely online, regardless of the time of day or night, the customer can apply for a convenient and attractively priced loan, which he or she can use for the further development of his or her e-store. Exactly when he needs it and when it is convenient for him. Thanks to cooperation with PragmaGO, our users can experience for themselves the practical benefits for business of implementing truly fintech solutions.

Lukasz Piechowiak

Head of Financial Services, Shoper

Company loan – what does it consist of?

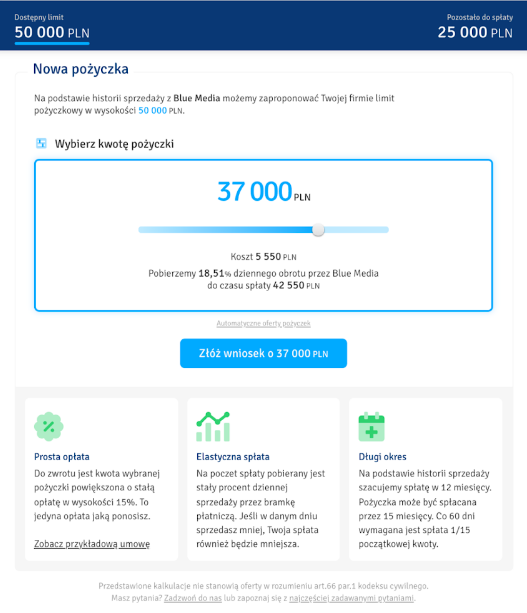

1. Merchant receives information about the individual available funding limit – even before they apply for it. This limit is calculated automatically, among other things. Based on the store owner’s turnover. All you need to do is set up an account at Brutto.co.uk (PragmaGO Group) through Shoper Payments (operator of Autopay).

(2) The presentation of an individual financing limit is possible thanks to the technical integration between Brutto.pl (PragmaGO Group) and Shoper Payments (operator of Autopay).

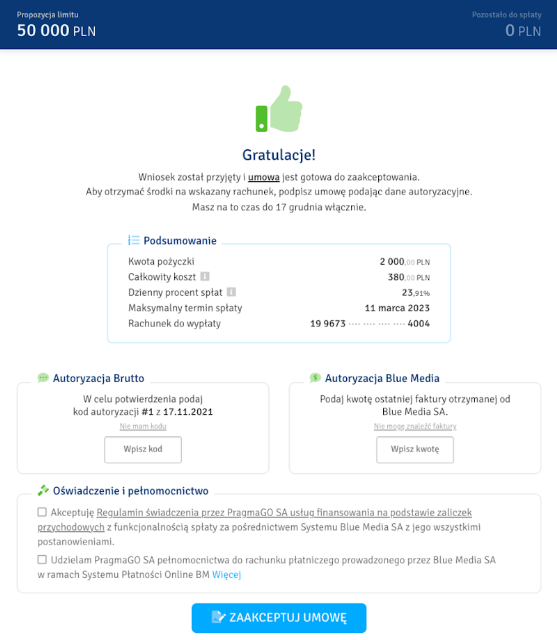

3 The entrepreneur selects the amount of the loan, checks the terms of the agreement, and then signs it with an SMS code. He receives the funds directly to the company account by express transfer.

4 The repayment will be collected automatically, and the amount will depend on the merchant’s current sales and turnover.

Money even in the middle of the night

5:27, 21:39, 23:40 – even at such hours Shoper merchants apply for a company loan. It’s very convenient – the entrepreneur comes home from work, focuses on his private life, then at any time he can get back to business and take care of its financing. He will receive the money in his account even the next day and can immediately use it, for example, to purchase goods or marketing activities to increase sales.

61% of merchants who have used a company loan are reaching for it again!

Benefits for merchants

Without leaving home, anytime

Access to money 100% online, without visiting bank branches.

Up to 150,000. PLN for any business expenses

Clear information about the amount of the maximum limit, calculated on the basis of previous turnover in Shoper Payments (operator Autopay).

Flexible repayment

The repayment amount is adjusted according to the merchant’s turnover in Shoper Payments (Autopay operator).

Repayments taken automatically

The entrepreneur does not have to remember and repay and make separate transfers.

You too can offer your customers deferred payment for B2B

Introduce new payment methods that can achieve up to three times the value of your shopping cart.